I am happy to share insights from our latest Ventana Research Value Index research, which assesses how well vendors’ offerings meet buyers’ requirements. The 2023 Analytic Data Platforms Value Index is the distillation of a year of market and product research by Ventana Research. Drawing on our Benchmark Research, we apply a structured methodology built on evaluation categories that reflect real-world criteria incorporated in a request for proposal to data platform vendors supporting the spectrum of analytic use-cases. Using this methodology, we evaluated vendor submissions in seven categories: five relevant to the Product Experience: Adaptability, Capability, Manageability, Reliability and Usability, and two related to the Customer Experience: Total Cost of Ownership/Return on Investment and Validation. This research-based index evaluates the full business and information technology value of analytic data platforms offerings. I encourage you to learn more about our Value Index and its effectiveness as a vendor selection and request for information/requestion for proposal tool.

Our Value Index for Analytic Data Platforms represents technology vendors and products  designed to store, manage, process and analyze data across on-premises, hybrid and multi-cloud environments, enabling organizations to leverage data to operate with greater efficiency. Analytic data platforms support applications used to analyze the business, including decision support, business intelligence, data science, and artificial intelligence and machine learning. They include real-time analytics data engines, data warehouses and data lakes as well as the increasing convergence of data warehouse, data lake and data-streaming technologies.

designed to store, manage, process and analyze data across on-premises, hybrid and multi-cloud environments, enabling organizations to leverage data to operate with greater efficiency. Analytic data platforms support applications used to analyze the business, including decision support, business intelligence, data science, and artificial intelligence and machine learning. They include real-time analytics data engines, data warehouses and data lakes as well as the increasing convergence of data warehouse, data lake and data-streaming technologies.

The 2023 Analytic Data Platforms Value Index evaluates the following vendors that offer products considered analytic data platforms as we define it: Actian, Amazon Web Services, Cloudera, Databricks, EDB, Google, IBM, MariaDB, Micro Focus, Microsoft, Oracle, SAP, Snowflake and Teradata. Three of the 14 suppliers responded positively to our requests for information and provided completed questionnaires and demonstrations, while three suppliers provided more limited information for the research.

Online material that was generally available was used for the analysis, along with briefings and any information the vendor did provide. Vendors that meet our inclusion criteria and that do not participate in our Value Index are assessed on publicly available information and this could have significant impact to their Value Index classification and rating. This report includes products generally available as of September 30, 2022.

Unlike many IT analyst firms that rank vendors from an IT-only perspective or consider futures or vision over what is available in the products today, Ventana Research has designed the Value Index to provide a balanced perspective of vendors and products that is rooted in an understanding of business drivers and needs. This approach not only reduces cost and time but also minimizes the risk of making a decision that is bad for the business. Using the Value Index will enable your organization to use analytic data platforms to achieve the levels of organizational efficiency and effectiveness needed for engaging digital experiences to meet your buyer, consumer, customer and partner needs.

We urge organizations to do a thorough job of evaluating analytic data platform products and services, and offer this Value Index as both the results of our in-depth analysis of these vendors and as an evaluation methodology. In addition to evaluating existing suppliers, the Value Index can be used to provide evaluation criteria for new projects. Applying our research can shorten the cycle time when creating an RFP.

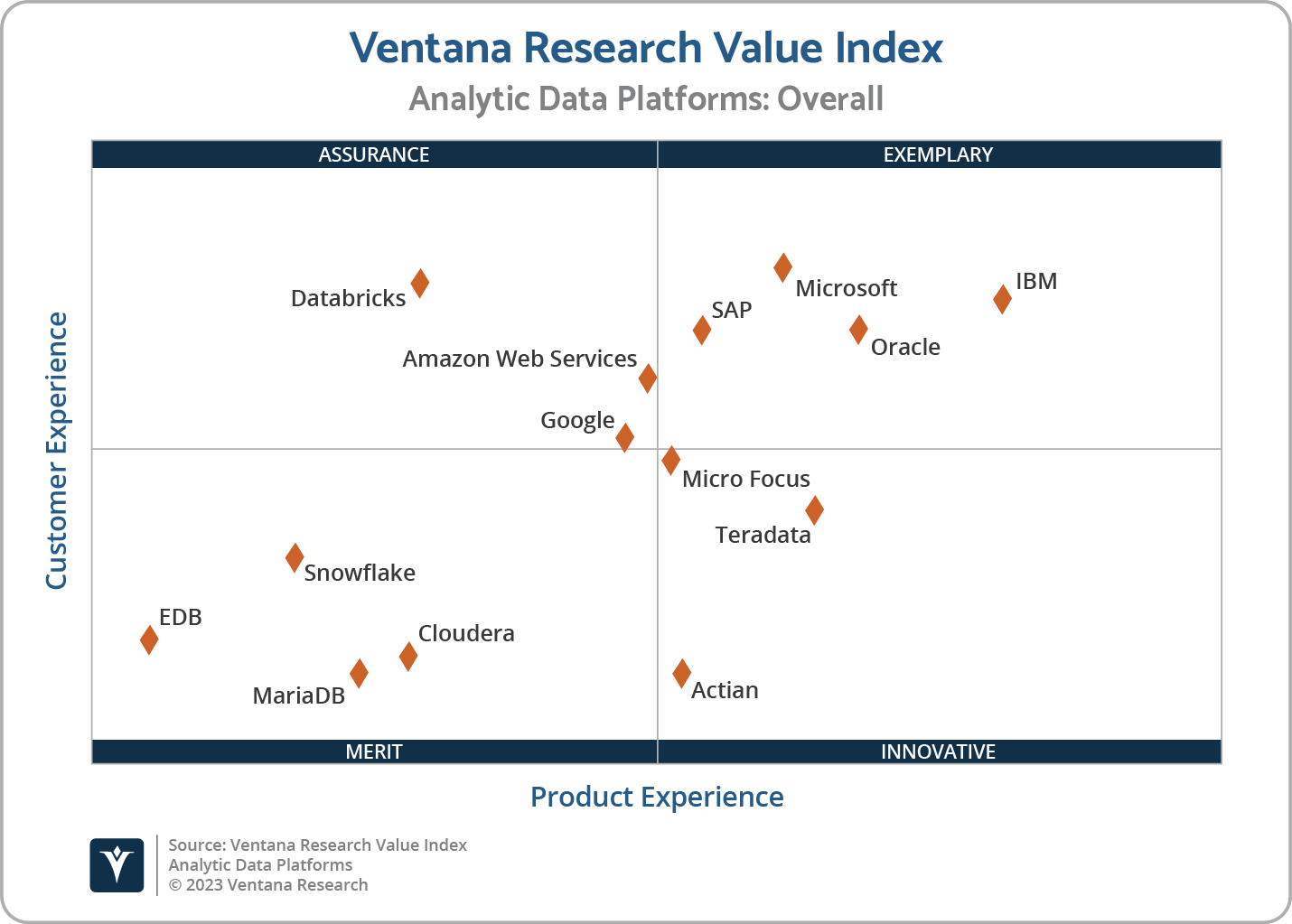

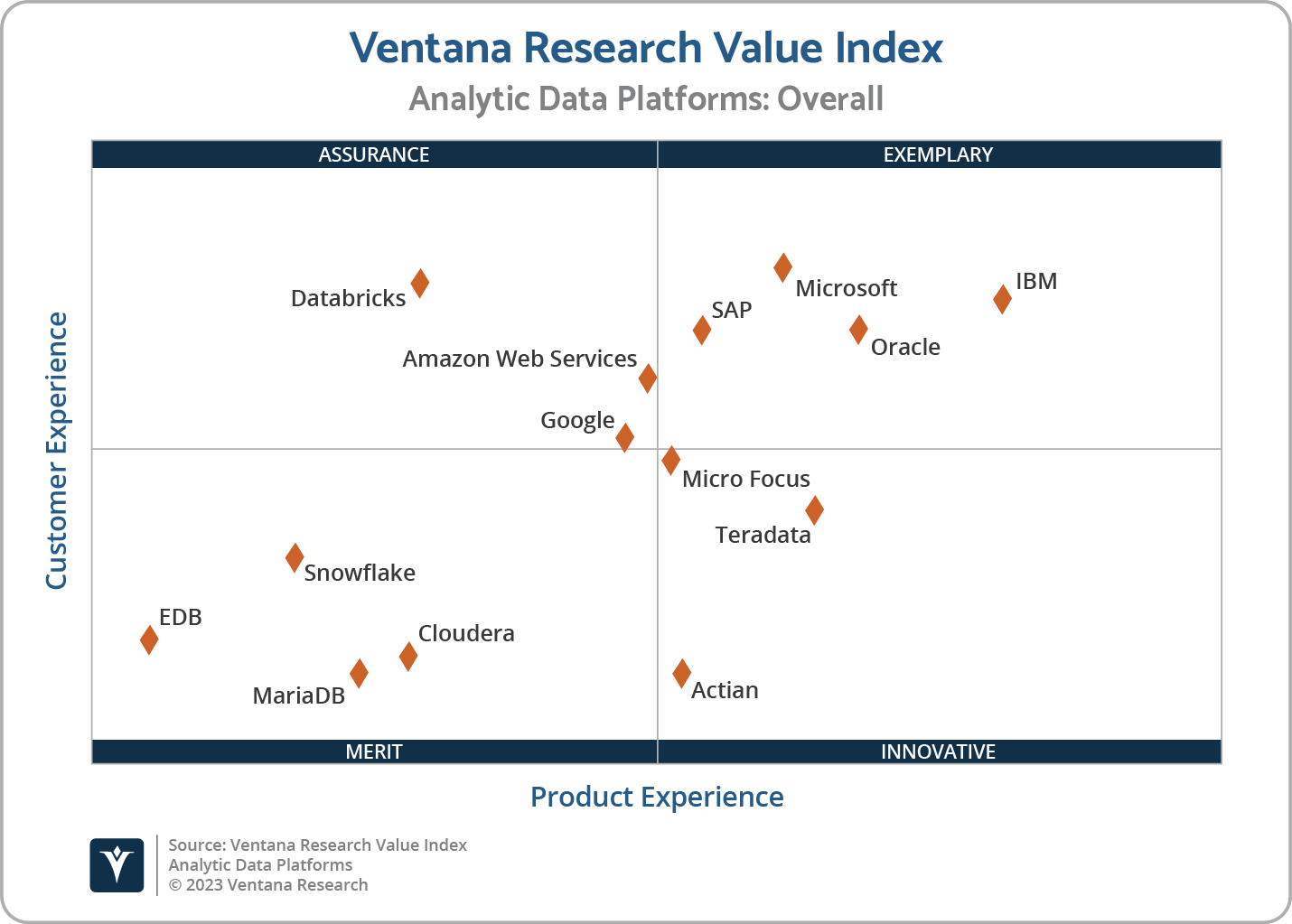

The Value Index for Analytic Data Platforms in 2023 finds IBM first on the list, with Oracle in second place and Microsoft in third. Companies that place in the top three in any category earn the designation Value Index Leader. IBM has done so in five of the seven categories and Oracle in three. Actian, Amazon Web Services, Databricks and Teradata place in the top three in two categories and MariaDB, Micro Focus and SAP placed in one category. All nine companies are Value Index Leaders.

The overall Value Index performance chart provides a visual representation of how vendors rate across product and customer experience. Vendors with products scoring higher in a weighted rating of the five Product Experience categories place farther to the right. The combination of ratings for the two Customer Experience categories determines the placement on the vertical axis. As a result, vendors that place closer to the upper right are “exemplary” and rated higher than those closer to the lower left and identified as vendors of “merit.” Vendors that excelled at customer experience over product experience have an “assurance” rating, and those excelling instead in product experience have an “innovative” rating.

We warn that close vendor placement should not be taken to imply that the packages evaluated are functionally identical or equally well suited for use by every organization or for a specific process. Although there is a high degree of commonality in how organizations handle data, there are many idiosyncrasies and differences in data platform functionality that can make one vendor’s offering a better fit than another’s for a particular organization’s needs.

All of the products we evaluated are feature-rich, but not all the capabilities offered are equally valuable to users or support everything needed across the entire life cycle of use. Moreover, the existence of too many capabilities may be a negative factor for an organization if it introduces unnecessary complexity. Nonetheless, you may decide that a larger number of functions is a plus, especially if some of them match your organization’s established practices or support an initiative that is driving the purchase of new software.

Issues beyond features and functions or vendor assessments may become a deciding factor. For example, an organization may face budget constraints such that the TCO evaluation can tip the balance to one vendor or another. This is where the Value Index methodology and the appropriate category weighting can be applied to determine the best fit of vendors and products to your specific needs.

We have made every effort to encompass in this Value Index the functional requirements and capabilities of our research blueprint. Even so, there may be additional areas that affect which vendor and products best fit your particular requirements. Therefore, while this research is complete as it stands, utilizing it in your own organizational context is critical to ensure that products deliver the highest level of support for your projects in this area.

You can find more details on our site as well as in the Value Index Market Report.

Regards,

Matt Aslett

designed to store, manage, process and analyze data across on-premises, hybrid and multi-cloud environments, enabling organizations to leverage data to operate with greater efficiency. Analytic data platforms support applications used to analyze the business, including decision support, business intelligence, data science, and artificial intelligence and machine learning. They include real-time analytics data engines, data warehouses and data lakes as well as the increasing convergence of data warehouse, data lake and data-streaming technologies.

designed to store, manage, process and analyze data across on-premises, hybrid and multi-cloud environments, enabling organizations to leverage data to operate with greater efficiency. Analytic data platforms support applications used to analyze the business, including decision support, business intelligence, data science, and artificial intelligence and machine learning. They include real-time analytics data engines, data warehouses and data lakes as well as the increasing convergence of data warehouse, data lake and data-streaming technologies.